’Tis the season to be jolly — but it’s not so jolly for many consumers, as the holidays can cause financial stress and often put consumers into debt. The thoughts that go into shopping are often spontaneous and also about “fulfilling dreams” or making up for something that often causes people to spoil kids, parents, colleagues or even oneself.

Holiday Spending has many consumers saying bah humbug!

A national survey by Experian finds that shoppers risk debt by not budgeting properly for the holiday season

According to a nationwide survey from Experian, the primary reason is that most consumers don’t create budgets and are unprepared to cover added expenses beyond gifts, such as postage costs, hostess gifts, gift-wrapping supplies and greeting cards.

Failure to develop a budget (62 percent of survey respondents) is huge detractor from holiday enjoyment. Fifty-six percent of those surveyed say they spend too much during the holiday season, while 55 percent say they feel stressed about their finances during the holidays.

Holiday costs add up

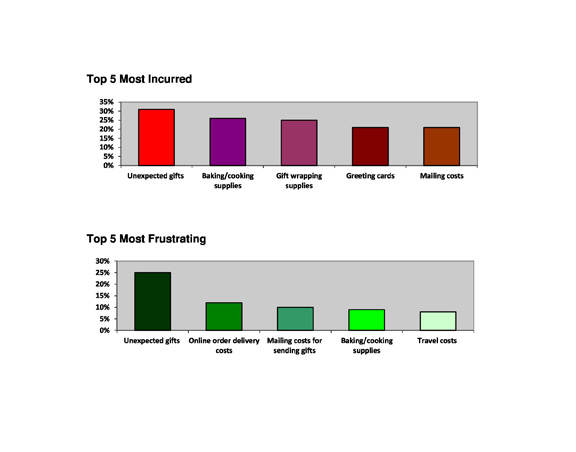

Respondents reported spending an average of $288 during past holidays on unexpected expenses, and 28 percent actually spent more on these than on gifts. These added expenses impact consumers’ finances, with 31 percent saying they have actually accrued credit card debt as a result.

“What consumers don’t realize is that after the merriment of the holidays they won’t be having such a happy new year, because they will be saddled with debt,” said Rod Griffin, director of Public Education at Experian. “With a little bit of planning, consumers can save themselves a lot of stress and put themselves in a better financial position in 2017.”

What are the top unexpected holiday expenses?

The risks consumers are willing to take to get a good deal and save money, such as purchasing from an unknown or unsecure website, are equally troubling. Nearly a quarter (23 percent) say they would risk becoming a victim of identity theft for a good Cyber Monday deal. Additionally, 46 percent say they are simply not concerned about identity theft this holiday season.

The risks consumers are willing to take to get a good deal and save money, such as purchasing from an unknown or unsecure website, are equally troubling. Nearly a quarter (23 percent) say they would risk becoming a victim of identity theft for a good Cyber Monday deal. Additionally, 46 percent say they are simply not concerned about identity theft this holiday season.

“Risking one’s identity for a good deal by purchasing from unsecured websites is obviously not a good idea,” added Griffin. “Unfortunately, the financial damage from identity theft will not make that deal worth it in the long run. With identity theft all too common during the holidays, consumers need to take precautions to protect their identities, such as checking their financial accounts and monitoring their credit report and credit score throughout the season.”

Additional stressors for consumers:

- 48% said they spend more than expected.

- 44% feel obligated to spend more than they can afford when buying holiday gifts.

- 43% of those who feel stressed about the holidays say it’s because they have no extra money to buy gifts — 8% higher than 2015.

5 tips for holiday budgeting

- Make a gift list: Create a list of the people you need to buy presents for and how much you will spend on each person. Giving yourself a set amount at the start will help you stay focused when you’re on the gift hunt.

- Start early: By avoiding the Christmas Eve shopping rush, you’ll find better deals — and avoid overspending under pressure.

- Budget for unexpected expenses: Look outside your gift list and think about the ways you spend extra money around the holidays. Hostess gifts, baking and cooking supplies, and postage costs can add up to big expenses.

- Keep track of spending: Make sure you track every dollar you spend, and track spending as you go. This will hold you accountable.

- Be careful with credit: Use credit cards only if you are sure they will not tempt you to stretch your budget and can be paid in full when you receive your statement. Also, check your credit score periodically to see how your spending is affecting your score.

Want to know what kind of holiday spender you are? Visit the Experian Credit Education blog to take our interactive quiz.

For more information on budgeting, as well as how debt can affect credit scores, visit the Experian Credit Education blog. Consider enrolling in a credit monitoring service such as Experian CreditWorksSM, which can help you better track and manage your credit report and score.

About the survey

The online survey was conducted by Edelman Berland on Experian’s behalf from Oct. 5 to 12, 2016, among 1,000 adults 18 years of age or older who reside in the United States. This online survey is not based on a probability sample; therefore, no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact ann@pitchpublicrelations.com.

About Experian Consumer Services

The Experian Consumer Services division provides credit monitoring and other informational products, such as identity protection, to millions of consumers via the internet. The organization enables consumers to monitor their credit reports online, check their FICO® Scores and protect against identity theft. Its products include Experian CreditWorks℠ and ProtectMyID®. Experian Consumer Services has established integrated, cobranded relationships with leading online financial destinations that provide consumers with a broad range of comprehensive online financial products and information essential to managing one’s financial life. For more information, visit http://www.experian.com.

About Experian

We are the leading global information services company, providing data and analytical tools to our clients around the world. We help businesses to manage credit risk, prevent fraud, target marketing offers and automate decision-making. We also help people to check their credit report and credit score and protect against identity theft. In 2016, for the third year running, we were named one of the “World’s Most Innovative Companies” by Forbes magazine.

We employ approximately 17,000 people in 37 countries and our corporate headquarters are in Dublin, Ireland, with operational headquarters in Nottingham, UK; California, US; and São Paulo, Brazil.Experian plc is listed on the London Stock Exchange (EXPN) and is a constituent of the FTSE 100 index. Total revenue for the year ended March 31, 2016, was US$4.6 billion

To find out more about our company, please visit http://www.experianplc.com or watch our documentary, “Inside Experian.”

Experian and the Experian marks used herein are trademarks or registered trademarks of Experian Information Solutions, Inc. Other product and company names mentioned herein are the property of their respective owners.

Do make sure that you budget for holiday purchases. By doing so and plotting out sales you can buy exactly what you need and also get discounts in the process. I would like to thank Experian for this great post on how to budget for holiday shopping

Stevie Wilson,

LA-Story.com

______________________________________________________________________________

DEALS and STEALS(Affiliate Links)

I curate deals that offer bonuses, bargains, and great products –and some are very specifically for this site to feature to my audience because I want my audience to get amazing products from great brands! If you purchase via my link, I make a very small percentage for that purchase.

Target

Find Cosmetic Accessories and Tools at Target.com!

Mini facial eraser sponges Blends makeup flawlessly Includes 2 erasers that can be used up to 6 times Achieve a photo-quality look with the Real Techniques Miracle Mini Facial Erasers – 2 pk. This essential beauty tool helps blend your makeup to new heights, seamlessly polishing edges and lines to absolute perfection. Real techniques miracle facial eraser, makeup sponge, beauty tool

Sephora.com

Choose 1 of 3 sample bags when you spend $45 or more. Use Code: BAGOFCHEER. While supplies last.

Labor Day Sale! 20% Off LUNA 2 & ESPADA Valid 9/1 – 9/4 Using Code: LABOR17

Temptu: Friends and Family Deal 25% off!

Subscribe to RSS headline updates from:

Powered by FeedBurner

If you are going to feature content from LA-Story.com including images, podcasts or videos including the accompanying text, please respect copyright provisions. We require a notation of content origination (meaning credit tag), a linkback to the specific page & please email the link to stevie@la-story.com before the piece goes live. LA-Story.com, LA-Story Recessionista, Celebrity Stylescope, Celebrity Style Slam Trademark/Copyright 2017-19