Thanks to Michael Brown from LendEDU for reaching out to me to share this staggering report on the current state of the US economy via surveys with people about how they will celebrate Christmas and/or the holiday season and buy gifts (and food and other requirements for the holidays).

Dealing with both the pandemic recession & holiday shopping,

63% of Americans told LendEDU they will be taking on a record amount of credit card debt this holiday season.

This includes

–72% of people who were laid off during the pandemic, and

–75% of people who are still laid off.

Since March, millions of Americans have faced a tremendous financial struggle because of the coronavirus pandemic & recession that has led to mass unemployment.

Nine months later, the financial struggles have yet to subside.

Now it’s the holiday season, a time when money is spent and budgets are stretched.

To meet holiday expenses during an economic crisis, many consumers have no other choice but to rack up credit card debt and worry about repaying it later.

LendEDU’s newest study found many Americans–and the unemployed especially-– are going to be taking on record amounts of credit card debt to cover costs during a holiday season marred by the pandemic and resulting recession.

Table of Contents

Observations & Analysis includes information on the following:

–Pandemic is Reducing Holiday Budgets & Leading To Credit Card Debt

–For 63%, Credit Card Debt From the 2020 Holiday Season Will Be the Most They’ve Ever Taken On

—For Most, Holiday Debt Just Piling Up On Top of Earlier Credit Card Debt From Pandemic

—Americans Losing Sleep Over Large, Pandemic-Induced Credit Card Debt Balances

All data found within this report is based on a survey commissioned by LendEDU and conducted online by survey platform Pollfish. In total, 1,000 adult Americans were surveyed.

The appropriate respondents were found via Pollfish’s age filtering feature.

This survey was conducted on December 1, 2020. All respondents were asked to answer all questions truthfully and to the best of their abilities.

See more of LendEDU’s Research here.

Observations & Analysis

–All data is based on an online survey of 1,000 adult Americans commissioned by LendEDU and conducted by research firm Pollfish.

–The survey was conducted on December 1, 2020.

–For some questions, the answer percentages may not add up to 100% exactly due to rounding.

Pandemic is Reducing Holiday Budgets & Leading To Credit Card Debt

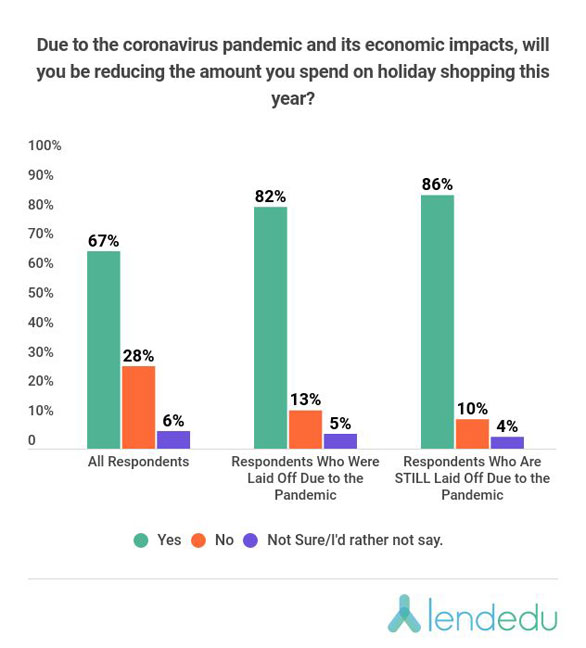

–67% of all respondents indicated they are reducing holiday shopping this year because of the coronavirus pandemic and its economic impacts.

–While that’s a high percentage to begin with, take a look at how the percentages change when only respondents who have been laid off from their jobs during the pandemic are counted.

–For nearly all Americans that have had their jobs impacted due to the coronavirus pandemic, holiday budgets will be reduced.

–Many of these people will also have to take on credit card debt to cover their holiday season shopping after seeing their own personal savings wiped out during the pandemic recession.

–One-third of all respondents will be financing holiday purchases via credit card debt, compared to 48% of respondents who were laid off due to the pandemic, and 51% of respondents who are still laid off because of the pandemic.

Rather than give you the entire report in this post, here’s the link for you to see the ENTIRE report and survey done by LendEDU.com

You can get much more information and be able to easily scroll up and down the survey online. This is a very deep survey but worth being aware of ALL of this very meaningful information!

Wonder who put this all together?

I would like to thank LendEDU.com and Michael Brown for giving me access to this survey and report. It’s so important to see the depth of the financial crisis that’s coming at us…

(and looming in the future of the Biden administration!)

Stevie Wilson

LA-Story.com

Want to leave a comment or ask a question? Please send an email to stevie.wilson@LA-Story.com

________________________DEALS and STEALS(Affiliate Links)

I curate deals that offer bonuses, bargains, and great products –and some are very specifically for this site to feature to my audience because I want my audience to get amazing products from great brands!

Disclosure: some of the links on this post might have affiliate links! It costs you nothing. If you buy something, the brand pays me a small percentage.

If you purchase via my link, I make a very small percentage for that purchase. It does not add any additional cost to the product. The price you see is the retail price (depending on store or vendor) .

Sunscreens Are Essential in Summer: Try COOLA Full Spectrum 360 Sun Silk Drops SPF 30

COOLA’s breakthrough Sun Silk Drops— your daily Full Spectrum 360° protection from the sun, environmental toxins, and digital overexposure.

Their advanced organic formula is light-as-air yet protects against broad-spectrum UVA/UVB, IR (infrared), and HEV (high energy visible) Light, meaning they’ve got you covered from beach to board meeting. A fast-absorbing complex blend of plant stem cells and patented LightWaves Defense [JS+M] technology helps to prevent visible signs of aging from both indoor and outdoor daily aggressors. Finally, full-spectrum organic skincare that keeps up with your everyday modern lifestyle!

What else you need to know:

This product is formulated without oxybenzone. It is vegan, non-GMO, TSA-friendly, and cruelty-free.

Available at Sephora.com and Coola.com

Subscribe to RSS headline updates from: http://feeds.feedburner.com/la-story/Bpyd

Powered by FeedBurner

If you are going to feature content from LA-Story.com including images, podcasts, or videos including the accompanying text, please respect copyright provisions. We require a notation of content origination (meaning credit tag), a link- back to the specific page & please email the link to stevie.wilson@la-story.com before the piece goes live.

LA-Story.com, LA-Story Recessionista, Celebrity Stylescope, Celebrity Style Slam Trademark/Copyright: KBP Inc./TNBT Inc 2007-22