Obamacare Shopping for Christmas: Guest Blogger Eric Tyson Answers 10 FAQs from Americans Who Were Cancelled!

We are lucky enough to have financial expert and author on various finance topics, Eric Tyson here to talk about what happens to those who have gotten cancellation notices from their healthcare insurers! This is very relevant despite some recent changes because while certain things have been rescinded (namely cancellations of policies, one still needs to investigate what to check up on with your health care insurer) .

The holiday season is almost upon us, but if your health insurance has been canceled, you’re likely feeling anything but festive.

Here, I answer questions I’m hearing—and offer advice on how to cope with the stress and confusion of health insurance shopping.

You’d love to spend the next month and a half decking the halls, enjoying festive parties, and shopping for gifts for your family and friends. Unfortunately, if you’re one of the millions of Americans who buy their own health insurance, the “silver and gold” that will dominate your thoughts this holiday season is the silver and gold (and bronze and platinum) designations of the Obamacare health plans.

That’s right. Millions who buy individual health insurance have received letters from their providers (or will soon receive them) saying their policies have been canceled because they don’t meet the requirements of the Affordable Care Act. Often the letters suggest a “similar” ACA-compliant plan that is—surprise!—a lot more expensive.

For most of the recipients these letters are an unwelcome holiday surprise. They feel blindsided. In many cases they worry about whether they can afford hundreds of dollars more a month in premiums or pay a steeper deductible than before. ACA supporters point out that the ACA-compliant “replacement” plans are pricier because they offer more benefits—but many people chose their (now canceled) plans precisely because they didn’t want or need, say, maternity coverage or prescription drug coverage.

When you pay for your own health insurance you tend to make educated purchasing decisions aimed at conserving costs and getting value for your money.

Many of these people are self-employed and have unpredictable cash flows, or perhaps they found the individual marketplace offered a better value than a spouse’s group plan. They deliberately bought high-deductible plans to keep premiums low. Let’s say you’re a middle-aged woman with a home-based business. Since you’re past childbearing age you chose a catastrophic plan without maternity coverage—and now you’re finding out that’s no longer an option. It’s upsetting.

I have fielded many questions from people seeking to understand the new health insurance rules and their personal finance implications. Here are some of them along with my answers:

Why did my policy get canceled?

Individual plans that were in effect as of March 23, 2010, were “grandfathered,” meaning that you get to keep them even if they don’t meet the standards mandated by the ACA. However, if the policy has been altered since that date—i.e., if the deductible, co-pay, or benefits changed at all—you can’t keep it. Most policies have been changed since that date, for a variety of reasons, so they are being canceled.

In addition, people who buy individual health insurance tend to change plans often anyway—so some people are losing coverage because they changed insurance policies in, say, 2011.

I’ve seen estimates that as many as 80 percent of individual policies will end up being canceled. So if you haven’t gotten a letter yet, chances are you will.

Yikes! On the policy my insurance company recommended to replace my canceled one, the premium has doubled and the deductible has gone up by thousands of dollars. How can this be?

It’s because of the essential health benefits that, by law, must be included in new insurance policies that take effect in 2014. These include maternity and newborn care, mental health and substance use disorder services, prescription drugs, pediatric services (including dental and vision care), to give a partial list. In the past you were able to pick and choose from plans that excluded some of these services and thus were less expensive.

Plus, the ACA includes “consumer protection” provisions that have elevated prices. For example, it prohibits health insurance companies from limiting or excluding coverage related to preexisting health conditions. In order to absorb this cost and costs related to other provisions, insurance companies have raised rates across the board.

Is my family eligible for a subsidy?

It depends on your family income and how many children you have. Beginning in 2014 subsidies will be available to qualified individuals and families whose incomes fall in the range of 138 percent to 400 percent of the poverty line (assuming they buy a policy on a government exchange). At the top of the spectrum, an individual making just under $46,000 would be eligible for a subsidy, as would a family of four earning around $94,000.

If you are self-employed and end up receiving subsidies, be careful to keep track of your earnings. If you end up making more than you thought you would in a given year, you could end up having to pay back part of your subsidy. Of course, the converse is also true: If you make less than expected, you may receive a refund.

What happens if I don’t replace my canceled policy?

If you do not replace your canceled policy with a qualified health plan, you will have to pay a penalty fee on your tax return. The penalty fee for 2014 is $95.00 per adult and $47.50 per child (up to $285) or 1 percent of your annual income—whichever is greater. This penalty rises sharply thereafter; in 2016 it will be $695 per adult and $347.50 per child (up to $2,085.00) or 2.5 percent of annual income—again, whichever is greater.

Wouldn’t it be smarter to just pay the penalty? (It’s much cheaper.)

Certainly, some people will choose to go this route. I have noted some anecdotal evidence suggesting that an “If I get sick then I’ll get insurance since people with preexisting conditions can’t be turned down” mindset is prevalent.

One problem with this strategy is that beginning in 2014 you can purchase subsidized health insurance (barring special circumstances like the birth of a baby) only during Open Enrollment—between October 15 and December 7 of each year. If you miss that window and get diagnosed with a serious illness in January you would have to wait many months to buy coverage on the government exchanges.

You can, however, purchase a policy outside the exchange at any time—but banking on the ability to get insured quickly enough is risky.

A major car accident or illness can happen too quickly to allow you to buy a policy. The medical bills that you would rack up almost overnight could devastate most people financially.

How long do I have to choose a new policy?

To avoid a penalty fee you must apply for a Qualified Health Plan by March 31, 2014. This deadline was extended from February 15 due to serious problems with the healthcare.gov website. But don’t let the extension make you complacent.

If your current health insurance policy expires at the end of 2013, you will still need to make a decision by December 15 to be covered by your new policy on January 1.

How can I find the best policy for me?

There are several ways to do so. You can visit either healthcare.gov or your state’s exchange if you think you might be eligible for a subsidy. If you have an independent insurance agent you like and trust, it might be best to call her.

Regardless of how you purchase your insurance you will find that qualified health plans have one of four designations: bronze, silver, gold and platinum. Bronze plans have the lowest monthly premiums and the highest out-of-pocket costs. Platinum plans are the opposite: They have the highest premiums and the lowest out-of-pocket costs.

Generally, the high-deductible bronze plans are the way to go for most relatively healthy people. They have the lowest premiums. You just have to be disciplined enough to set aside money for the higher out-of-pocket costs that could occur. In fact, choosing a bronze plan that’s compatible with a Health Savings Account is even better, as it allows you to set aside money for medical expenses on a tax-free basis.

I’ve talked to several insurance agents and insurers and have heard conflicting information. How can I know what to believe?

Obamacare is deeply confusing and not just to consumers. The insurance company employees and agents have to learn many new rules and regulations and this takes time. That’s why I suggest you talk to several different insurers and agents and do a fair amount of research before making a decision.

It’s important to invest some time in this decision. A woman told me she was looking for an HSA-compatible plan and, at first, her insurance agent told her the company was no longer offering them. The agent had been told this by two insurance company representatives. After making several more phone calls and asking some probing questions, the agent found out the company representatives had been wrong. If something doesn’t sound right, it pays to keep questioning.

Why is this happening only to individual policyholders? Is it going to affect people who get their insurance through their workplace?

Basically, most group policies already had more comprehensive (and expensive) coverage in place that met more of the standards of the ACA. So far it appears that most larger employer plans are seeing smaller changes. However, some employers are choosing not to offer coverage, asking employees to cover more of the cost, or deciding to go with more part-time employees (fewer than 30 hours/week) for whom they don’t need to provide coverage.

To see exactly what happens to most group coverage we’ll just have to wait. Almost certainly, though, some smaller businesses will face rate increases—and how this directly affects employee pocketbooks will vary wildly.

It seems that this has happened to a lot of people in my state. However, I have heard from people in other states that their costs haven’t increased. How can this be?

There are various reasons for the disparity. Experts suggest that costs spiked more dramatically in states that have fewer regulations on insurance to begin with. Thus, states that previously did not require insurers to provide benefits like preventative care and contraceptives now have to—so their prices necessarily rise. Also, in general, states where more insurers are competing for customers will have lower prices.

The truth is, Obamacare is helping some people in the short-term and hurting others. As a financial counselor it is not my place to offer an opinion on whether this law is a positive or negative force for our country. I can only advise individuals to educate themselves, seek out the best value for their needs and their wallet, and go into this transaction—like any transaction—with their eyes open.

What Eric Tyson has suggested here is that you talk to people at your state’s insurance exchange (providing your state has one) Also if you are part of a group healthcare plan, talk to your company’s HR department. If you have an independent insurance agent (that means like Farmers, State Farm and also independent insurance brokers ) , contact them and ask lots of questions and ask for plan comparisons to be emailed to your or sent to you so that you can print out hard copies. Ask for copies of what the policies require and what the basic costs are. Gather your information and see if someone has a spreadsheet comparison set up– or ask your agent to create one. If your employer has one- ask them to print you a copy or email you a copy. It’s about doing some research and doing significant comparison shopping and looking realistically at your healthcare costs over the past couple of years and looking realistically at what the next two are most likely going to be. Yes– in some ways that’s like looking at a crystal ball but in others, if you have kids, you can talk to your doctors and pharmacist and get some ballpark ideas of what the cost is. If you have an accountant who does your taxes, talk to the accountant and also look at your tax return because if you have medical costs that didn’t quite meet the bar for decductions, you should look at those costs and figure that this new plan would take care of all of those costs and not be so out of pocket on them.

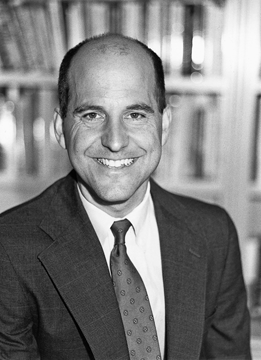

ABOUT Eric Tyson:

Eric Tyson is an internationally acclaimed and bestselling personal finance book author, syndicated columnist, and speaker. He has worked with and taught people from all financial situations, so he knows the financial concerns and questions of real folks just like you. Despite being handicapped by an MBA from the Stanford Graduate School of Business and a BS in economics and biology from Yale University, Eric remains a master of “keeping it simple.” After toiling away for a number of years as a management consultant to Fortune 500 financial-service firms, Eric took his inside knowledge of the banking, investment, and insurance industries and committed himself to making personal financial management accessible to all.

Eric’s “Investor’s Guide” syndicated column, distributed by King Features, is read by millions nationally. He is the author of five national bestselling books, including Personal Finance For Dummies, Investing For Dummies, and Home Buying For Dummies (coauthor), among others, which are all published by John Wiley & Sons, Inc. Personal Finance For Dummies was awarded the Benjamin Franklin Award for best business book of the year.

Eric’s work has been featured and quoted in hundreds of publications, including Newsweek, the Wall Street Journal, the Los Angeles Times, the Chicago Tribune, Forbes magazine, Kiplinger’s Personal Finance magazine, Parenting magazine, Money magazine, Family Money magazine, and Bottom Line/Personal magazine; on NBC’s Today show, ABC, CNBC, PBS’s Nightly Business Report, CNN, and FOX-TV; and on CBS national radio, NPR’s Sound Money, Bloomberg Business Radio, and Business Radio Network.

Eric’s website is www.erictyson.com.

About the Book:

Personal Finance For Dummies®, 7th Edition (Wiley, 2012, ISBN: 978-1-118-11785-9, $22.99) is available at bookstores nationwide, major online booksellers, or directly from the publisher by calling (877) 762-2974.

Thanks to ERIC TYSON for his extremely insightful article. It’s very helpful and does clarify things quite a bit. There will be another article from him and one also from me.

Stevie Wilson,

LA-Story.com

Complimentary Dior deluxe sample with any $25 purchase. Code: DIORLOVE

20% of Pacifica Body Butters. 100% Vegan & Cruelty-Free!

$10 off $50 at Beauty.com!

Subscribe to RSS headline updates from:

Powered by FeedBurner

If you are going to feature content from LA-Story.com including podcasts or videos including the accompanying text, please respect copyright provisions. We require a notation of content origination (meaning credit tag), a linkback to the specific page & please email the link to [email protected] before the piece goes live.

LA-Story.com, LA-Story Recessionista, Celebrity Stylescope, Celebrity Style Slam Trademark/Copyright: KBP Inc./TNBT Inc 2007-13

forgive me for saying but this does seem unnecessarily complicated and bureaucratic – in an area where people need care and support

Fiona, it’s more complicated where the states haven ‘t set up their individual exchanges or sites to apply in for their state’s rules for health insurance and with the various state approved health care entities to offer their own policies for each state. Ever insurance company has to have a separate array of policies for each state (because that’s how they do business… it was not a govt choice necessarily but one that the insurance companies wanted to do from prior iterations of selling insurance policies)

So California’s state exchange is doing quite well, the staff is friendly, helpful and offer to check with a supervisor so that the consumer on the phone or on the site can get the correct information I have had 5 people I have talked with and they have been very kind, generous with their time and double-checked that they were giving me correct information unlike the insurance entities staff who don’t care if they give me the wrong information (that’s soooooooooooo true)

Complicated does not begin to describe it, Fiona…First you need to know that most Americans are financially illiterate…don’t even understand how insurance works and why they might benefit from it….Most are stuck in a bubble of serious political hooooo ha that supports the corrupt and creepy system ( private insurance gone mad)we have now. It is now causing much more mental illness than it is addressing..for starters.